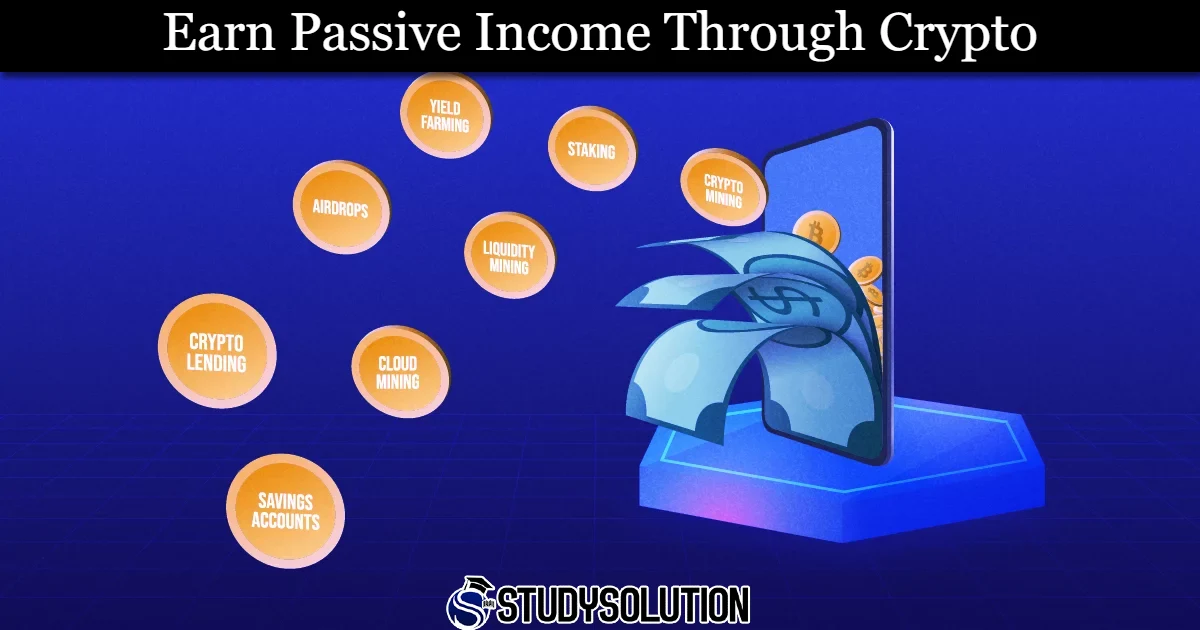

How to Earn Passive Income Through Crypto

Anybody with an internet connection thanks to cryptocurrency, a special kind of money can engage in a distributed economy. This covers the possibility of generating passive income. Although investing in and making money with cryptocurrencies may seem similar to using a bank account or social lending platform, there are distinct risks involved.

Here’s a closer look at using cryptocurrency to generate passive income.

IMPORTANT NOTES

- The distributed finance economy allows interest to be earned with cryptocurrency.

- Anyone with the necessary accounts and technical know-how can take part from anywhere in the world.

- Platforms for lending and earning cryptocurrency come with special dangers and are not supported or insured by any government organization.

Farming by Yield

Decentralized finance (DeFi) systems enable users to participate directly in lending processes and make money like a bank. Users commit coins and tokens to a pool alongside other users by connecting their cryptocurrency wallets here. After that, that pool is utilized to make interest- and fee-only loans to other people.

Users may receive compensation for taking part in the loan process or interest based on the amount they deposit or maintain in their account. Three variables determine how much money is made from lending cryptocurrency: the length of the loan, the amount of the loan, and the interest rate.

Mining

Blockchain is the foundation of cryptocurrencies, and building a safe, functional chain requires numerous computers operating in parallel. The proof-of-work algorithm, which powers several of the most well-known cryptocurrencies, such as Bitcoin and Litecoin, is known as PoW. Miners, or participants from all around the world, compete with one another under proof-of-work to discover the encrypted solution to the block. The winner receives a Bitcoin award.

You can join a mining pool and use a spare computer you have at home as a miner. A graphics processing card (GPU), some computer and programming knowledge, and familiarity with setting up a client application to connect to a hosted one are typically needed for this.

You must participate in a pool and use the pool’s combined computing power to have an opportunity to win any cryptocurrency.

There are more methods besides staking Proof-of-work to obtain fresh coins. Proof-of-stake is a major rival (PoS). Owners of cryptocurrencies that stake their coins can take part in the consensus-building process on the network and get paid for their labor.

To stake cryptocurrency, you don’t need to be as tech-savvy. Staking may be enabled automatically by certain exchanges if you have appropriate currency in your account. To receive staking rewards for other currencies, you must keep the cryptocurrency in a hardware or software wallet that is compatible.

Play Games to Earn Money

Playing video games online is another way to generate passive cash. Play-to-earn cryptocurrency games are widely available these days, and they’re all different. Among the more well-known ones are Decentraland and Axie Infinity.12 These games became so well-liked in the Philippines during the pandemic that people who lost their employment could make money from them.3.

With cryptocurrency, who pays interest?

Each defi platform varies slightly from the others. The three main sources of funding for cryptocurrencies are network fees, borrower interest, and platform interest.

Is income from cryptocurrency taxable?

Income is subject to taxation regardless of its source. A cryptocurrency is regarded as a capital gain if you’ve held it for more than a year and sold it when its value increased. The easiest way to find out how to handle cryptocurrency income and whether it’s taxable in your circumstances is to speak with a tax expert or use tax software.

What Share of Cryptocurrency Should I Have in My Portfolio?

Everybody has different risk tolerance and investing objectives. There is no right or incorrect answer when it comes to the portion of your portfolio that should be in cryptocurrency. Cryptocurrency is not for everyone. It could be preferable to consult with a financial advisor who is more knowledgeable about the ins and outs of investing if you are unsure about how to move forward.

The Final Word

Using cryptocurrencies to generate passive income is a simple and intriguing way to diversify your earnings and assets. You might get sucked into the thrill of the cryptocurrency world by its high rates, which far exceed those offered by banks. You are double-dipping on interest and investment gains if you time it correctly and your cryptocurrency investment rises in value.

But there’s also a big chance of losing money, and a lot of investors have experienced the agony of a cryptocurrency platform going bankrupt and their entire portfolio losing value. Since each person has a different risk tolerance and set of investing objectives, you, along with possibly a reliable financial expert, must choose the appropriate proportion of crypto income investments—if any—that are best for your portfolio.

Pingback: Freelancing Websites For Students Without Investment

I like your blog

Pingback: A Guide To Earning Good Amount Every Day Through CoinPayU

Good

Its really good.

hey